Budgeting basics: The 50-30-20 rule

For one easy way to plan your spending, try this method.

In brief

- Understanding your spending can help you better plan for the future.

- The 50-30-20 rule organizes spending into needs, wants, and goals.

Creating a budget can help you make confident decisions and enjoy peace of mind. A detailed budget, though, can be complex to manage.

The 50-30-20 rule splits expenses into just three categories. It also offers recommendations on how much money to use for each. With some basic information, you can get on the road to financial well-being.

Getting started

Start by taking a look at your paycheck. If taxes are withheld, subtract that amount from your total earnings. Do not subtract other amounts that may be withheld or automatically deducted, like health insurance or retirement contributions. Those will become part of your budget.

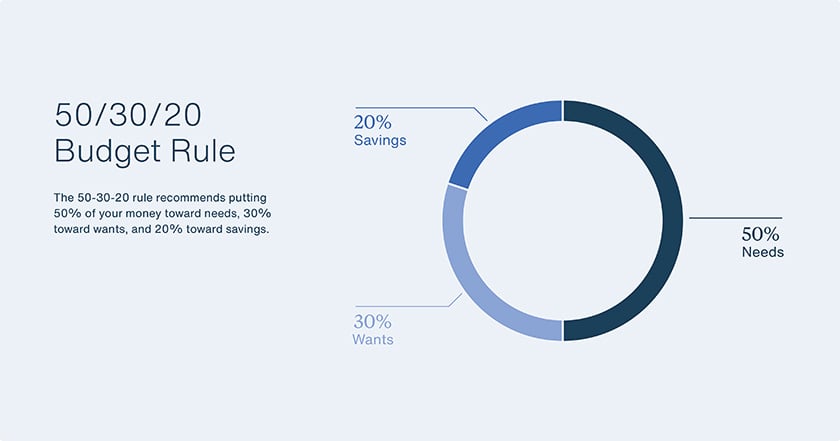

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let’s take a closer look at each category.

Needs: 50%

About half of your budget should go toward needs. These are expenses that must be met no matter what, such as:

- Utility bills

- Rent or mortgage payments

- Health care

- Groceries

If you can honestly say “I can’t live without it,” you have identified a need. Minimum required payments on a credit card or a loan also belong in this category.

Wants: 30%

You subscribe to a streaming service to watch your favorite show, not because you need the subscription to live. Wants are things you enjoy that you spend money on by choice, such as:

- Subscriptions

- Supplies for hobbies

- Restaurant meals

- Vacations

Savings: 20%

The remaining 20% of your budget should go toward the future. You may put money in an emergency fund, contribute to a retirement account, or save toward a down payment on a home. Paying down debt beyond the minimum payment amount belongs in this category, too.

In summary

Options to save for the future at UNFCU include savings accounts and share certificates.

The 50-30-20 rule is just one way to consider organizing your budget. To find the perfect fit for your situation, consult a professional financial planner.

You may also be interested in

Achieving financial well-being

Five tips for protecting your money during high inflation